Table of Contents

- w2 :: Mycity-Military.com

- W2 Product of the Month - Email Risk Assessment | The Payments Association

- 2024 W-2 Form Printable - Juli Saidee

- Usps W2 2025 - Etty Shanna

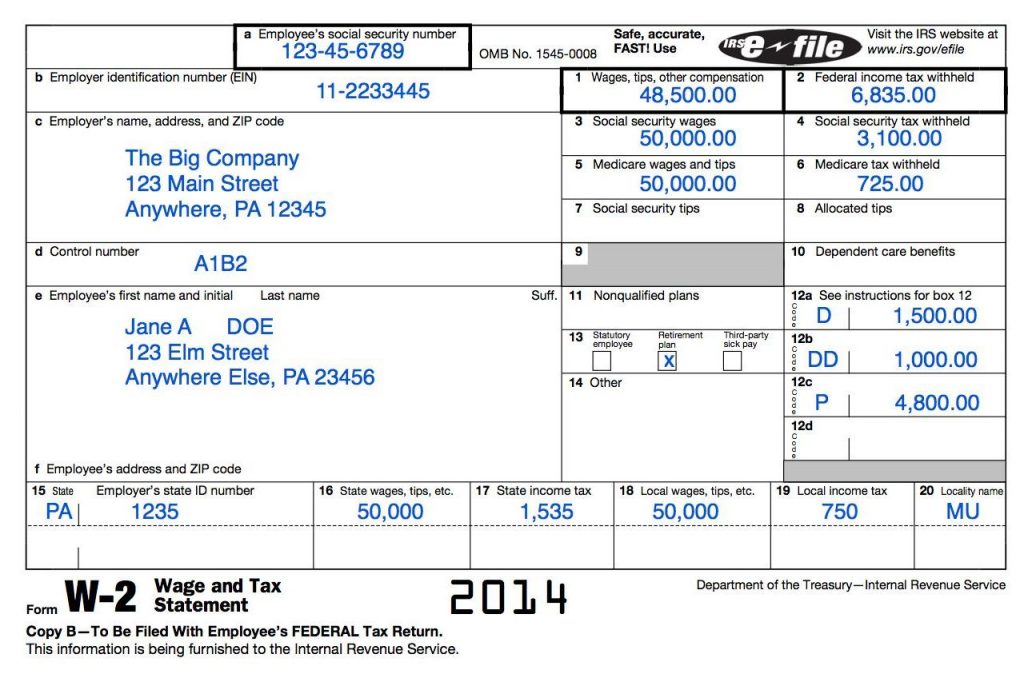

- What Is Dd Mean On W2

- Pin di w2e di 2024

- DOD's 2024 Audit Shows Progress Toward 2028 Goals > Air Force Life ...

- Amazon W2 2024 Former Employee Release Date - Korry Mildrid

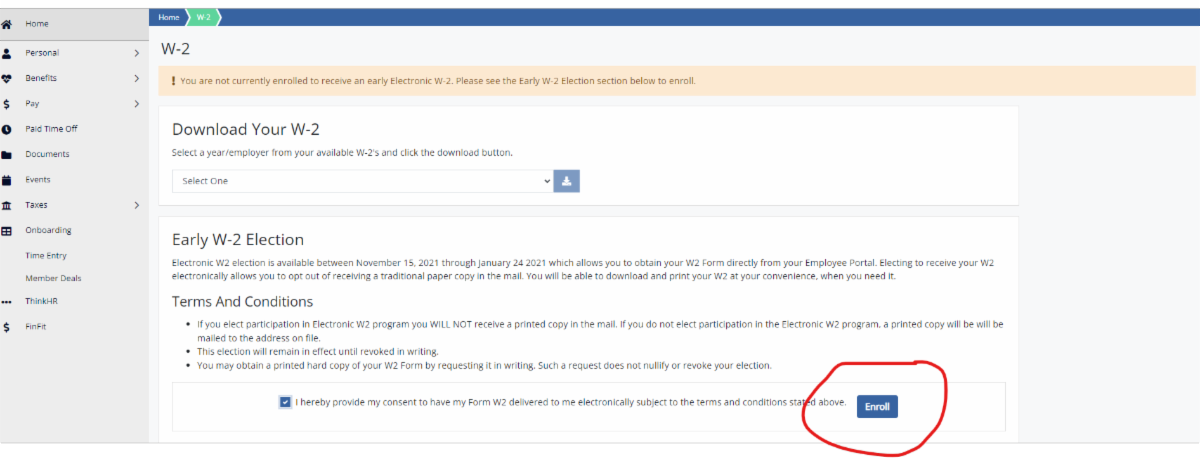

- Elect to get your W2 electronically for 2024!

- ADP W-2 data hacked in latest breach

The DFAS has confirmed that tax documents, including W-2s and 1099s, will be available to eligible recipients starting from January 22nd. This announcement is significant, as it provides taxpayers with a clear timeline for when they can expect to receive their tax documents, allowing them to plan and prepare their tax returns accordingly.

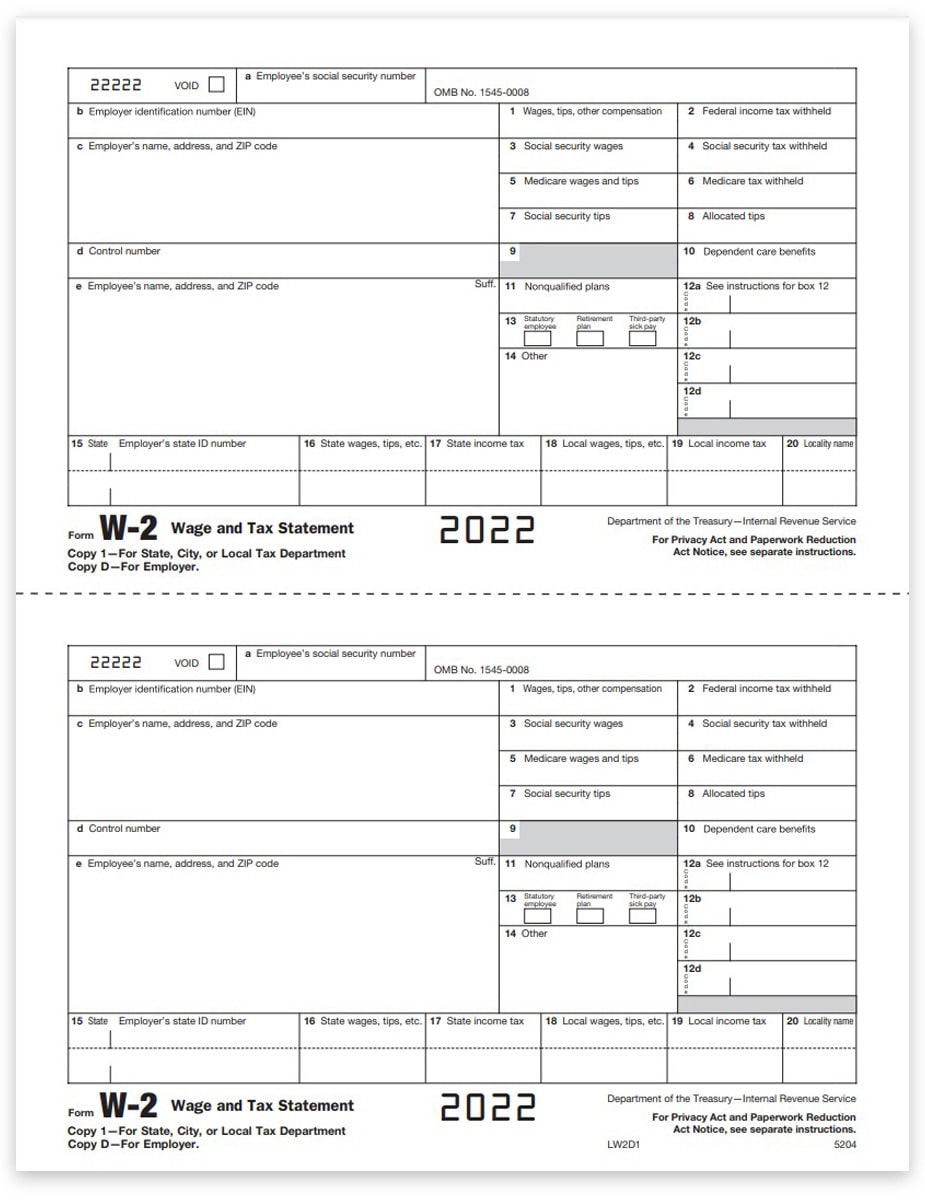

What Tax Documents Will Be Released?

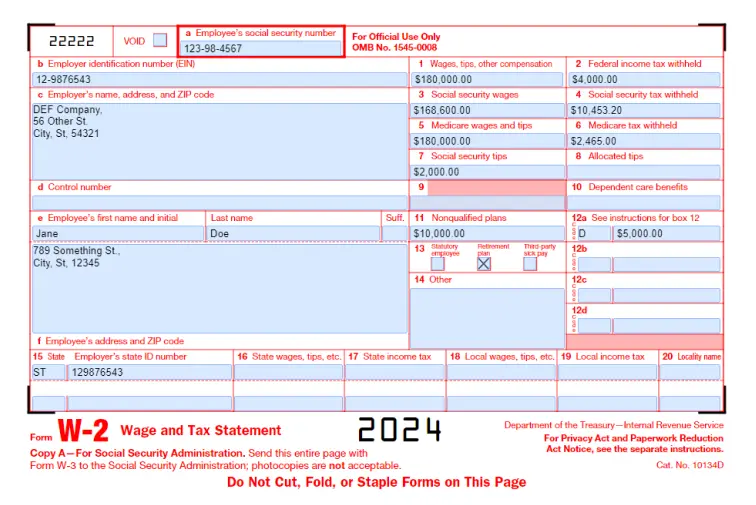

- W-2s: These documents will be available for military personnel, federal civilian employees, and other eligible recipients who earned income in the previous tax year.

- 1099s: These documents will be released for individuals who received non-employee compensation, such as contractors and freelancers.

These tax documents are essential for taxpayers to complete their tax returns, and receiving them on time will help ensure a smooth and efficient tax filing process.

How to Access Your Tax Documents

Eligible recipients can access their tax documents through the DFAS website or through the myPay online portal. To access your documents, simply log in to your account, navigate to the tax documents section, and download or print your W-2 or 1099.

Preparing for Tax Season

With the release date of tax documents announced, it's essential to start preparing for tax season. Here are some tips to help you get ready:- Gather all necessary documents, including your W-2, 1099, and any other relevant tax documents.

- Review your tax withholding and adjust it if necessary to avoid any potential tax liabilities.

- Consider consulting a tax professional or using tax preparation software to help with your tax return.

By staying informed and preparing ahead of time, you can ensure a stress-free tax season and take advantage of the tax credits and deductions you're eligible for.

The release of tax documents by the DFAS is an essential milestone in the tax season calendar. With the announced release date, taxpayers can now plan and prepare their tax returns with confidence. Remember to access your tax documents through the DFAS website or myPay portal, and start gathering all necessary documents to ensure a smooth tax filing process. By being proactive and prepared, you can navigate tax season with ease and make the most of your tax return.Stay tuned for more updates and announcements from the DFAS, and don't hesitate to reach out to a tax professional if you have any questions or concerns about your tax return.