Table of Contents

- Income Tax Bracket Adjustments for 2024: Potential Boost in Paychecks ...

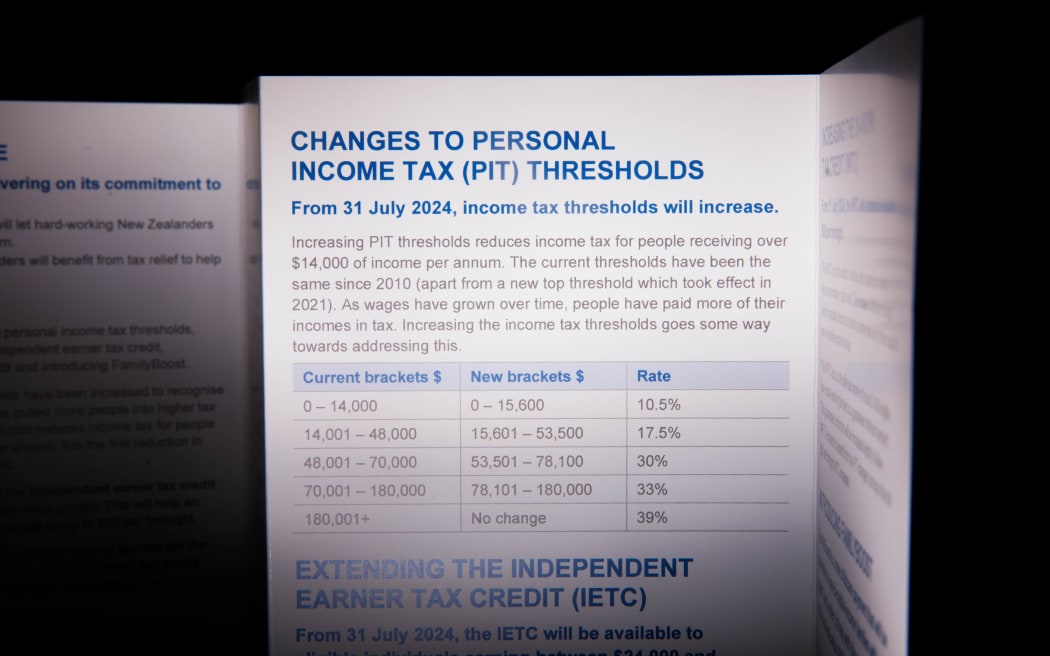

- Income tax brackets, capital gains: changes announced in 2024 budget ...

- What’s My 2024 Tax Bracket? | Hays Breard Financial Group

- What the 2024 Capital-Gains Tax Brackets Mean for Your Investments ...

- Budget 2024: Here Is How To Calculate Your Tax Relief

- New Bracket Thresholds, Rising Contribution Limits, and Other Tax ...

- New Bracket Thresholds, Rising Contribution Limits, and Other Tax ...

- How Project 2025 could impact your tax bracket and capital gains under ...

- Tax season 2024: Everything to know from deadline to extensions ...

- IRS announces 2024 income-tax brackets: Here’s what they mean for your ...

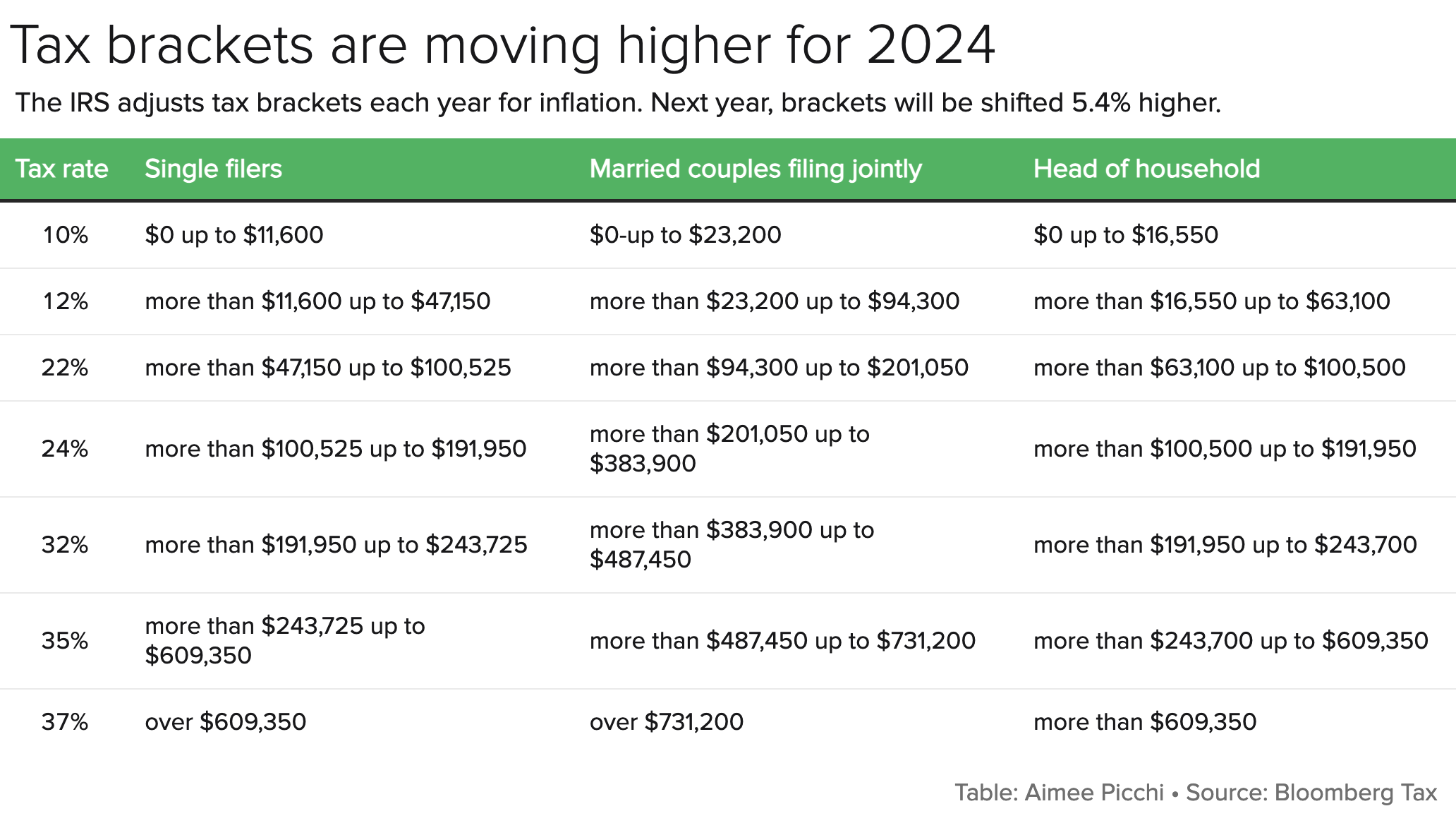

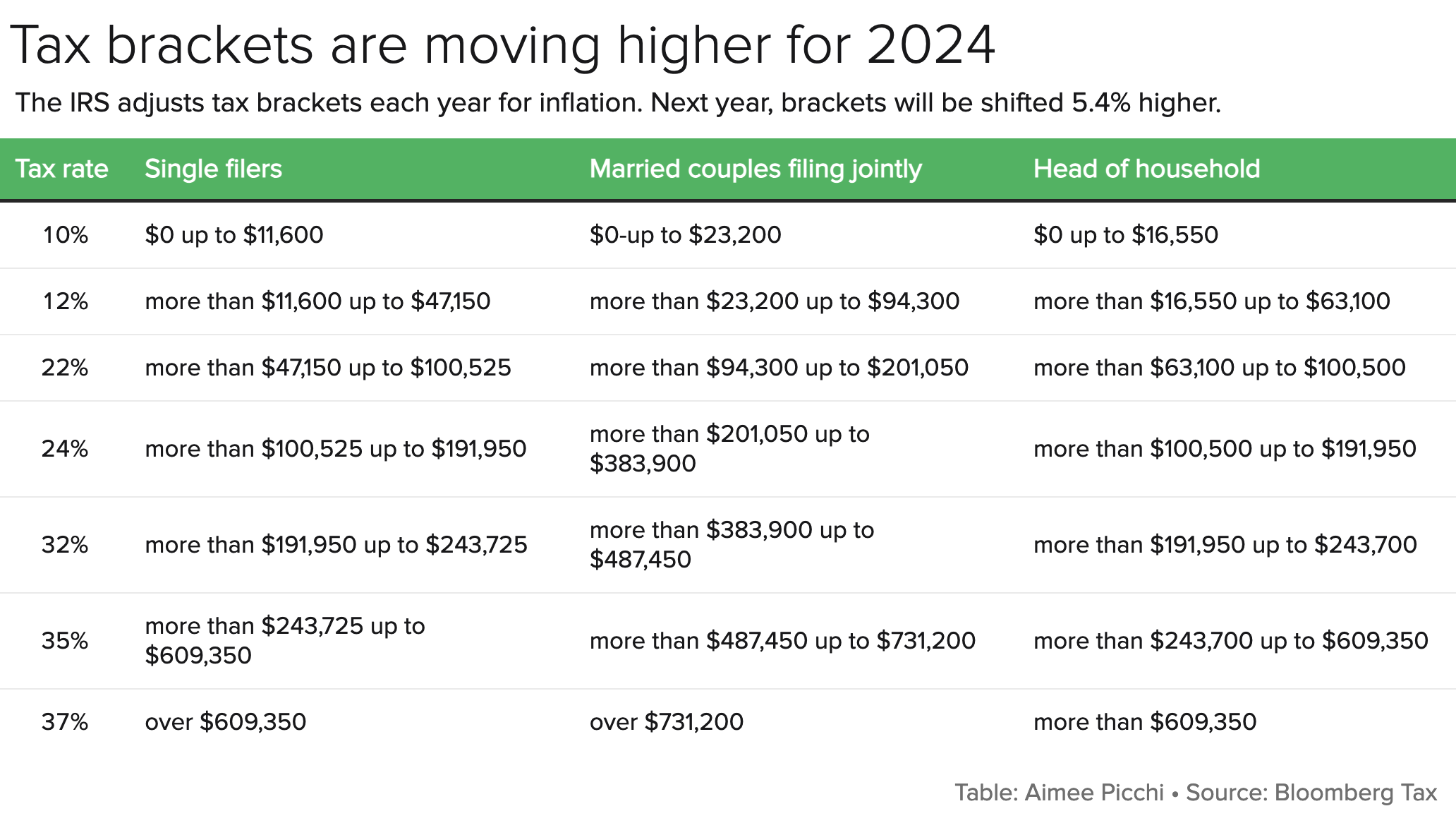

Understanding the IRS 2024 Tax Bracket Changes

How the IRS 2024 Tax Bracket Changes Will Impact Your Paycheck

Key Changes to the IRS 2024 Tax Brackets

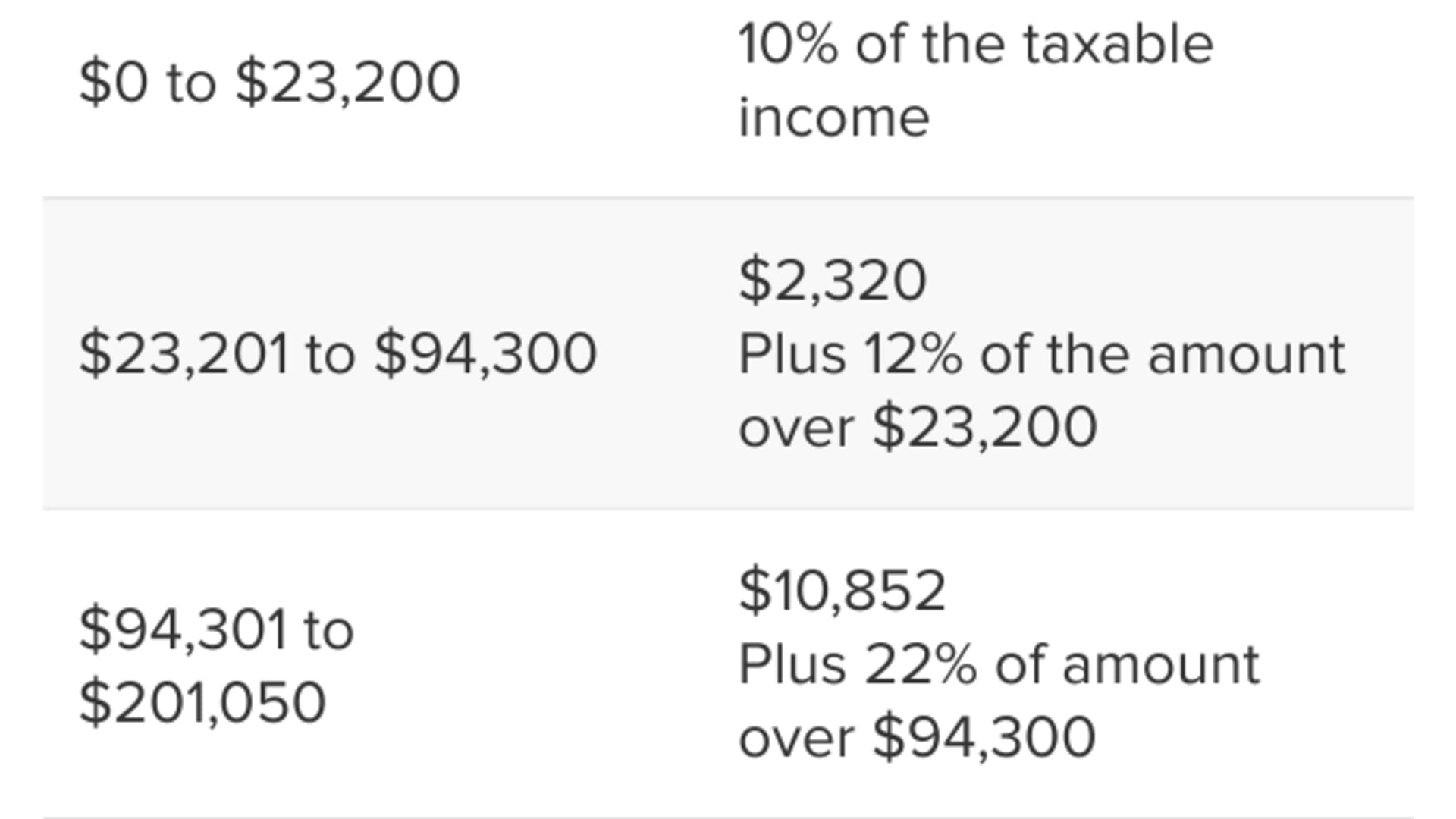

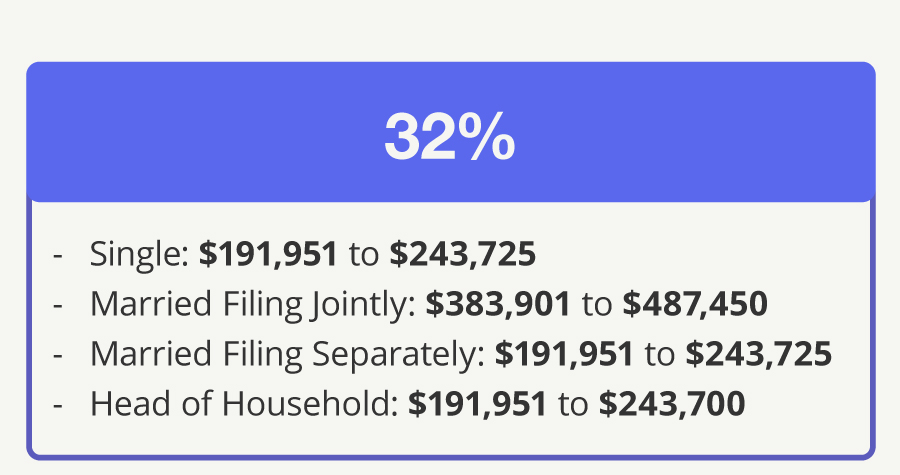

The following are some key changes to the IRS 2024 tax brackets: The standard deduction will increase to $14,050 for single filers and $28,100 for joint filers. The income range for the 24% tax bracket will increase to $47,150 to $100,525 for single filers and $94,300 to $201,050 for joint filers. The income range for the 32% tax bracket will increase to $100,526 to $191,950 for single filers and $201,051 to $383,900 for joint filers. The income range for the 35% tax bracket will increase to $191,951 to $243,725 for single filers and $383,901 to $487,450 for joint filers. The income range for the 37% tax bracket will increase to $243,726 and above for single filers and $487,451 and above for joint filers.

What You Can Do to Take Advantage of the IRS 2024 Tax Bracket Changes

To take advantage of the IRS 2024 tax bracket changes, you should review your tax withholding and adjust it as needed. You can do this by submitting a new Form W-4 to your employer. This will ensure that you are having the correct amount of taxes withheld from your paycheck. Additionally, you may want to consider consulting with a tax professional to ensure that you are taking advantage of all the tax savings available to you. The IRS 2024 tax bracket changes may result in a slightly bigger paycheck for many individuals. By understanding the changes to the tax brackets and adjusting your tax withholding accordingly, you can take advantage of these changes and keep more of your hard-earned money. Remember to review your tax withholding and consult with a tax professional if needed to ensure that you are maximizing your tax savings.Keyword: IRS 2024 tax bracket changes, tax bracket, paycheck, tax withholding, tax savings